From threads to trends - Navigating supply chain complexity in apparel retail

In India, apparel retailers often face supply lead times of 6-9 months, requiring brands to plan collections nearly a year in advance. This research, conducted in collaboration with NielsenIQ and based on a survey of 100 CXOs from various apparel brands, reveals that supply chain inefficiencies delay store drops by 15-30 days. Forecasting errors also result in inventory mismatches, with only 55%-65% of seasonal inventory selling at full price. Furthermore, manual and reactive in-season adjustments are often ineffective in significantly improving full-price sell-through. This leaves 30%-40% of stock to be offloaded during EOSS, impacting profitability. To break this cycle, the report suggests adopting a differentiated approach based on product lifecycle categorization and leveraging business intelligence for smarter inventory and merchandise management, enabling retailers to reduce markdowns, improve sell-through, and build a more agile, profitable business model.

Retail Reinvention Paradigm

With the retail sector undergoing unprecedented disruption due to the rise of quick commerce and digital channels, this report provides a roadmap for brands to reinvent their strategies. It highlights the resilience of brick-and-mortar retail in tier 2 and 3 cities, the importance of hybrid retail models, and the role of digital tools in enhancing customer experience. The report also offers insights from PwC’s research on consumer preferences, omnichannel retailing, and the need for policy-level interventions to level the playing field between traditional and digital-first retailers.

India’s Best Workplaces in Retail 2025

This study highlights the evolving workforce dynamics in India’s retail sector, identifying key factors that contribute to a great workplace. With employee satisfaction at an all-time high—88% of retail employees report a positive work experience—the report underscores the role of agility, innovation, and retention in shaping the future of retail talent. It also explores emerging trends such as the rise of tier 2 and 3 cities as retail hubs, the integration of digital tools for employee engagement, and the importance of building strong workplace cultures to drive business success.

India’s Changing Discretionary Spending – Key Insights for Brands

This report explores the evolving landscape of discretionary spending in India, driven by rising incomes, expanding credit access, and the growing influence of Gen Z and millennials. It highlights key consumption trends across sectors such as apparel, health & wellness, and food services, while also providing insights into the premiumisation of products and experience-led retail. The study offers strategic recommendations for brands to align with shifting consumer behaviors and thrive in India’s dynamic retail market.

RAI Report 2025: Winning in Bharat & India

This comprehensive report examines India’s retail growth trajectory, which is set to reach INR 190 trillion by 2034. It delves into the contrasting consumer behaviors across Bharat (rural and tier 2/3 cities) and India (metros and urban centers), providing strategic insights on how retailers can cater to diverse market segments. The study showcases best practices from successful retailers, emphasizing the importance of agility, digital transformation, and omnichannel retailing to win in this competitive landscape.

Building Equitable Workplace

The joint report by the Retailers Association of India (RAI) and Great Place to Work (GPTW), titled "Building Equitable Workplace: Insights from India's Best Workplaces in Retail 2024," offers a comprehensive analysis of the retail sector in India. It draws on the experiences of 1.8 lakh employees to provide insights into workplace dynamics. Key findings include the significant influence of a growing middle class, technological advancements, and evolving workforce needs. The report addresses critical issues such as gender and sexual orientation bias, identifying strengths and areas for improvement in the industry. It serves as a guide for creating more inclusive and equitable workplaces, highlighting the importance of responsible management and career growth opportunities as drivers of workplace satisfaction.

Unlocking the $2Tn Retail Opportunity

The BCG-RAI report identifies India as a significant retail opportunity, projecting the market to exceed $2 trillion in the next decade. India's rapid GDP growth, increasing from $1 trillion over 63 years to an expected additional $4+ trillion in the next 10 years, fuels this potential. Despite the pandemic, organised retail in India has consistently outperformed category growth, with certain sectors showing resilience and profitability in line with global peers. However, achieving both growth and profitability remains challenging. The report suggests an activist agenda for long-term value creation, emphasising the need for business model innovation, digital and AI integration, efficient value chains, new revenue streams, and localisation. Retailers are encouraged to adapt to shifts in consumer behavior and market dynamics to capitalise on this significant growth potential

Future of Retail: Profitable Growth through Technology and AI

The Deloitte report on "Future of Retail: Profitable Growth through Technology and AI" highlights the transformative role of emerging technologies like AI, IoT, MR, and advanced analytics in the Indian retail sector. These technologies are reshaping retail, offering personalised experiences and operational efficiencies. The report emphasises integrating technology with business strategies, focusing on measurable success through KPIs, and aligning technological investments with core business values. It advises a comprehensive approach to digital transformation, including change management, investment in talent, scalable solutions, and continuous measurement and adaptation. Retailers embracing these digital transformations can navigate market complexities, achieving differentiation and sustainable growth.

GPTW - Culture Quotient From Great to For All Insights from India

Discover which retail organizations in India have been named the Best Workplaces in Retail 2023, according to a recent report released by the Retailers Association of India and Great Place to Work

ANAROCK Retail - India Retail Real Estate: REvived, REshaped, & REinforced

This surge in demand and growing preference for organized retail has spurred a fresh wave of shopping center developments in major markets. A recent report from RAI and consulting firm ANAROK estimates that the top seven cities will see the addition of 25 million square feet of mall space over the next four to five years.

₹ 400 Bn EBITDA Opportunity with Advanced Analytics and AI in Retail

This report on ₹ 400 Bn EBITDA opportunity with Advanced analytics and AI in Retail", jointly developed by Boston Consulting Group (BCG) and Retailers Association of India (RAI), takes a comprehensive look at the potential opportunity in Indian context, and sheds light on innovative ways in which retailers globally are leveraging advanced analytics and AI across the value-chain to unlock value.

The report also shares overview of the maturity level and extent of current adoption of advanced analytics and AI by Indian retailers, various approaches taken and challenges faced. Further, the report also covers a roadmap for Indian retailers including how to get started, the right approach, capabilities and type of partnerships needed to ensure successful adoption and value realization

Going Beyond Trust - The Power of Maximizing Human Potential

Racing towards the next wave of Retail in India

The India consumption story continues to remain strong despite the unprecedented challenges. Retail in India is growing at a fast pace and creating new opportunities for retailers. The report details the opportunities for retail in India while underscoring innovative practices adopted by retailers and the key emerging trends. The report also shares critical imperatives for the Indian retailers to succeed in the next year, and the next decade. The changing landscape demands retailers to be receptive to change and more agile in response to shifting consumer preferences.

Festive Shopping Index 2021

The Festive Shopping Index is an annual consumer sentiment survey by the Retailers Association of India (RAI) and LitmusWorld. It initiates conversations with Indian consumers to measure their shopping sentiment during the festive season. The Index predicts the predominant consumers' shopping behaviour during the festive season, which retailers can use as a guide to becoming more consumer-centric during the most crucial quarter of the year. To gain insights on consumer shopping preferences this festive season, download the latest edition.

The Resurgence of Retail in India

As the economy opens up, the rise in India

KNOW your consumer

The Covid-19 pandemic has caused disruptions across markets, leading to profound shifts in consumer behavior. The report is an attempt to help retailers understand their consumers so that they can manage and meet changing consumer expectations. It brings an interesting perspective to help them strategize in the new normal.

Employee = Customer, a report by Great Place to Work

Like every year this year too, RAI with Great Place to Work Institute, identified best workplaces to work in retail in India. It involved studying 26 retail organisations, representing the voice of 1,03,578 employees over a period of 12 months. The last few quarters were testing times for businesses in the Retail industry. However, the Best Companies in Retail followed the Employee = Customer Mantra to endure through the crisis and continued to build Trust with their employees and customers. The report details how the best workplaces in retail invested in their people in times of crisis.

Festive Shopping Index 2020

The fourth edition of the Festive Shopping Index is an annual consumer sentiment survey by the Retailers Association of India (RAI) and LitmusWorld. The survey initiates conversations with Indian consumers to measure their shopping sentiment during the festive season. The Index predicts the predominant consumers' shopping behaviour during the festive season, which retailers can use as a guide to becoming more consumer-centric during the most crucial quarter of the year.

Indian Retail

The report depicts the current state of the Indian retail sector, highlights the challenges and changes brought about by the unprecedented COVID-19 outbreak. It also conducts an impact assessment of demand-supply dynamics of malls, showcases the key trends that are likely to emerge in the post-COVID-19 era and depicts the measures taken by mall owners and retailers to ensure safety and well-being of their customers. The overall theme of the report depicts that while things look difficult today due to the COVID-19 outbreak and subsequent lockdowns that have resulted in business coming to a screeching halt, there is massive potential in the Indian retail sector. The learnings from the current crisis can go a long way in shaping up the future of the sector.

The New Retail Reality

This report sheds light on how the pandemic has led to a change in consumer behaviour and more importantly how the retail space is undergoing a complete makeover. Some of these changes include consumers becoming more digitally savvy, the increasing need for a touch-free shopping journey, price value equation, a rise in consumer awareness, popular discretionary spends, new product launches, local sentiments undergoing a change, increased consumer consciousness and last but not the least the online channel gaining traction.

The Online Private Label Growth Paradigm

In recent years, private labels have emerged as the rising stars of retail and e-commerce. Private labels typically offer shoppers value for money, while earning higher margins - around twice as much as external brands - for retailers and e-commerce players. Between 2019-22, private labels are expected to grow 1.3-1.6x faster than e-commerce platforms and continue to generate 1.8-2.0x higher margins than external brands. The report underlines key insights such as 1) Category -focused platforms were early entrants into private labels and have also benefited the most. 2) Online private labels foster customer retention leading to higher repeat purchases. 3) Private label growth and their higher profitability translates into better valuations.

Reimagining Grocery Retail - Unlocking Value & Growth through Platform Business Models

While enterprises worldwide are struggling to create a meaningful approach to digital transformation, modern ‘born digital’ businesses such as Amazon, Airbnb have been successful in creating tremendous value and disrupting incumbent business models. It is also evident that ‘Platforms’ are the secret sauce to the success of these ‘born-digital companies. This report talks on how can grocery retailers embark on a platform journey and how platform business models can create an integrated & collaborative ecosystem to unlock value and growth. It also highlights six key drivers that grocers should focus on as enablers towards creating a next-gen integrated grocery platform ecosystem.

Achieving The Business Imperative of Creating a Great Place to Work for All

Great Place to Work® Institute came together to identify India’s 10 Best Workplaces in Retail. This report represents the voice of over 1,04,921 employees across 32 organisations that were assessed to identify the best workplaces. It highlights significant positive shift inexperience of a demographic group that, traditionally, may not have been a part of mainstream employee agenda and experience. It is also concerning that feedback from women employees highlights the industry challenges that prevent them from participating in large numbers in the retail industry. The report summarises that there are some inherent contradictions within the industry that will need to be addressed for the retail industry to truly be a Great Place To Work® FOR ALL.

Retail 4.0: Winning the 20s - Three Decades Gone By, A New World of Possibilities Await

As we step into the next decade, we look back and reflect on the significant factors that have shaped Retail in India, and how the major retail predictions of the past decade have played out. This report analyses the Indian retail context and then talks about likely trends that could impact the retail industry in the next 5-10 years. It also plays back some of the Global and Indian understanding of the critical supply side themes such as retailer propositions, evolving competitive forces, and data and technology disruptions. Further, it discusses possible scenarios that might play out in the future of retail as well as outlines the way forward imperatives for retailers.

Digital Disruption in Retail

The report

RAI-Innoviti Retail Payments Insights

RAI- Innoviti Payment Insights gives an overview

of the growth at grass roots as it is based on payments data. The report incorporates samples from 36 states and union territories, 697

cities and sales by value of $10 B from a diverse collection of 20,230 modern

and general trade stores. It gives a balanced view of how economic and

macro-trends are impacting the sector.

Going for Gold: By creating customers who create customers

A businesses biggest advocate is a happy customer. Going for Gold is a report that extensively covers this customer, the one who has the drive and potential to bring more customers to the business and how to tap such customers. The report looks at the Indian consumer and market from different angles and brings to the table relevant insight that will certainly do the work of an alchemist for any retail business in the country and turn the business to Gold.

The Indian Consumer – Unravelled

Customer-experience will be the biggest differentiator in the coming years and this report intends to equip retailers with the reinforcements to capitalize on this. The report aims to highlight the trends that are shaping Indian retail like the growth of e-commerce due to the sheer volume of smartphones coupled with the penetration of the internet and the FDI policy of the nation. The report has isolated consumer sub-sectors to further the understanding of consumer shopping behaviour. ‘Unravelling the Indian Consumer’ focuses on market changes, and how they will transform the way consumers shop and the industry functions.

Indian Retail: It's Time to Create Stores with Stories

Retail in India is at a crossroad; It is weaving a new story for itself. A story built around the customers and not the product or the business. Companies that do better on Customer Experience (CX) achieve 25% higher gross margin than their peers. 40% of customers switch to competitive offerings as a result of poor experience. And it is7X more expensive to reacquire customers than it is to retain. AT Kearney's report narrates the story of the Indian retail industry along with the protagonist' the Indian Consumer.

Customer Experience (CX): The Epicenter of Retailing

Building a High Trust Culture: A Competitive Advantage

For the seventh year in a row, Great Place to Work® Institute and Retailers Association of India (RAI) came together to identify India’s 10 Best Workplaces in Retail. These 10 best workplaces are shining beacons of a High-Trust, High-Performance CultureTM and have successfully positioned themselves as an Employer of Choice. The research represents the voice of over 8500 employees across 30 organizations that were assessed to identify the best workplaces. The research shows that employees under 35 years of age form 78% of the workforce in the retail industry; and the best workplaces have identified that focussing on these employees is key to their business success. The results are evident with 84% of this workforce expressing an “Intent to Stay’ in the best workplaces as against 71% in the rest of the workplaces in retail. The growth in the industry also poses a challenge of retaining this workforce and the best workplaces in retail have 7% of the employees less than 35 years of age at flight risk, with this number doubles to 14% in the rest.

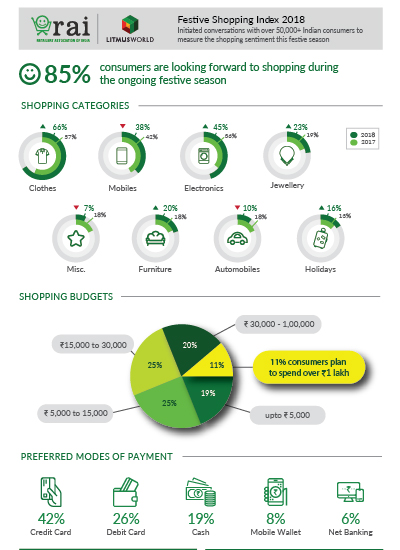

Festive Shopping Index 2018

This is the 2nd edition of Festive Shopping Index which reveals consumer preferences on several aspects of shopping. Retailers Association of India, in partnership with LitmusWorld has been engaging with consumers since last year to understand the key shopping criteria for consumer during festive season. The Festive Shopping Index is an effective way of understanding what consumers want to do during festive season. It provides important insights about what consumers want, which retailers can use to formulate their strategies for the season to become more consumer centric.

Customer Experience - The New Operational Excellence

Based on a survey of almost 2508 consumers across 108 brands and 9 sectors in the Indian market, the report identifies which brands consumers ranked highest for customer experience excellence. Brands were ranked across The Six Pillars of Customer Experience Excellence to identify the leaders across- Personalisation, Integrity, Expectations, Resolution, Time & Effort and Empathy. The report further states that with India having an incredibly diverse population, brands have to cater to a wide range of customers from a plethora of backgrounds, cultures and varying sensibilities. The winners are those organisations, which appeal to a customer’s core values, score high on the integrity quotient and reduce friction in the transaction cycle.

Retail FDI in India

Any consumer who experiences a higher propensity to spend eventually tends to shift his preferences towards branded products. There are multiplayers in the market who contribute a gamut of brands – whether a single brand or multiple brands under their respective umbrellas. The current foreign investment policy of India relevant to the consumer business segment allows regulated flexibility to global brand giants looking to enter the Indian consumer retail space to tap the boom in demand for assorted products.

This report provides details on the models permissible under Indian regulations to operate in the retail space with respect to foreign investors, the opportunities they offer from a business standpoint as well as a few challenges peculiar to the Indian marketplace scenario.